A Recent Take on the Pending UPS Strike with Scarbrough’s Own Geoff Chambers

From his days managing broad supply chain strategies for major international brands to his time coordinating asset-based trucking strategies, Geoff draws from a broad spectrum of logistics roles to inform his work with Scarbrough Consulting. He carries extensive insight into domestic truck and rail transportation, supply chain optimization, project management, and more.

Geoff briefly reflects on the tension between UPS and Teamsters and the likelihood of a strike.

Written by Geoff Chambers, Director Supply Chain Services, a Division of Scarbrough Consulting

I clearly remember UPS’ last strike 26 years ago, in 1997. The landscape of Parcel & Express services was entirely different. UPS had around 180,000 Teamsters vs. over 300,000 today, and the Teamsters had not lived through the black swan event of COVID, along with its surge of package volume. The temperament of the Teamsters was much more engaged and the strike lasted 15 days. At the time, RPS (now FedEx Express), Airborne, and DHL were collectively blanketing UPS shippers to move their volume quickly before the strike. Many shippers followed suit and left UPS; however, the aftermath of the strike was unprecedented. Neither RPS (FedEx Express), Airborne, DHL nor the USPS could keep up with the surge of package volume. Consequently, service interruptions as well as misrouted deliveries were commonplace. Moreover, it directly influenced current customers for all the carriers. I undoubtedly recall one of the parcel carriers delivering periodicals for a nationwide news magazine out of the back of pickup trucks. The strike was unmistakably a debacle.

Historically, it was in the 1990s when e-commerce began to grow with Amazon being one of the first to start selling products online. While much has been published about the strike, I have not read one article about UPS’ ties to Amazon which represents around 25% of their package volume. In 2022 for example, Amazon led e-commerce sales representing over 37% of e-commerce volume far surpassing Walmart at 6%. Since Amazon has incorporated its own logistics services, the question remains how this strike will influence Amazon.

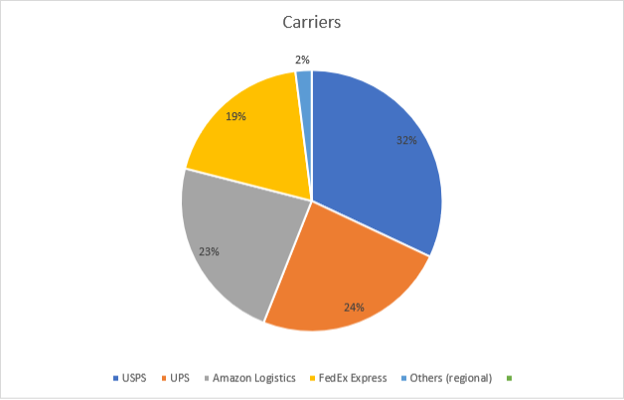

While most UPS competitors have some capacity due to the downturn of e-commerce package volume in 2023, there is a question of how much diversity and volume of packages, they will be willing to accept. Furthermore, if a strike does happen, and I do believe it will, the disruptions in our economy will be dramatic. This will flood the market with excess parcel packages and cause interruptions in service of entities such as USPS as well as FedEx Express. In fact, on Sunday, July 9th, the USPS launched their “Ground Advantage” program with 2–5-day transit times to mirror FedEx Express. Will this make a difference? I certainly hesitate based on the strike of 1997. To provide a diagram of the key vendors in the world of e-commerce, please note the diagram below taken from 2022 statistics:

Since UPS employees are covered under the National Labor Relations Act, there are few bargaining chips or jurisprudence for the Biden administration. Unlike Congress who recently intervened during last year’s potential strike or lockout with the railroad workers. Moreover, during the first part of 2023, I personally heard from a UPS Regional Sales Manager, who wished to remain anonymous, there was an internal announcement from UPS’ CEO to their sales and internal staff, that vacations would not be allowed during the month of August – clearly a significant statement pending the current contract expiration date on July 31st. Even with UPS’ office and sales staff, it will be impossible to deliver 20 million packages a day – UPS’s average daily volume. The Teamsters now are more single-minded with very little forbearance. While UPS seems to have lifted their “table ready” approach to negotiate.

In summary, most of the shippers who left UPS in 1997, went right back to them after the conclusion of the strike on day 16. It was several months before shipping conventionally resumed. While it is always a resilient move to have more than one vendor in place, it remains unforeseen how adaptive our world will be given the imminent strike.