BBGFX: All Eyes on the Fed

September FX outlook – FOMC the main focus

Major FX markets remained largely range-bound in August but the USD started to trade firmer towards the end of the month as Yellen’s comments at Jackson Hole along with previous comments from Dudley revived expectations of a Fed rate hike, some think as early as September. GBP was initially hit hard by Bank of England easing, but recovered through the month as UK data suggested that the impact of the Brexit vote had so far been minimal. The September FOMC meeting will be the major focus this month, but US data, particularly the August employment report on the 2nd, will color market expectations.

Main market movements in August

- The USD edged lower in the early part of the month as expectations of Fed tightening were reduced in the wake of the weaker than expected Q2 GDP data released at the end of July. While the negative views of the US economy were moderated by strong employment data released early in the month, the USD continued to struggle as expectations of Fed tightening continued to fade helped by FOMC minutes mid-month that were perceived as mildly dovish. However, the USD recovered by the end of the month helped by some more hawkish comments from Yellen at Jackson Hole.

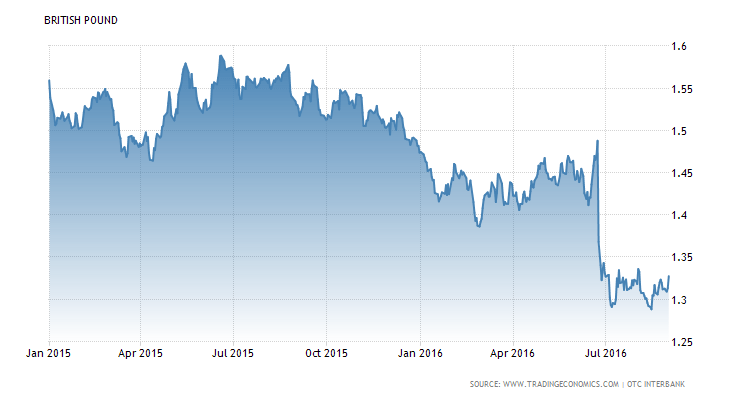

- Despite aggressive easing by the Bank of England in August, GBP only finished modestly weaker on the month, though it did make a new low for the year against the EUR (but not against the USD). The Bank of England both cut interest rates and expanded their quantitative easing program, and while easing had been expected, this was on the more aggressive side of expectations. However, by the end of the month there was evidence from UK data that the UK economy was showing few initial ill effects from the Brexit vote, notably from strong retail sales, and this ensured that GBP made a recovery by the end of month.

- Equity markets were generally well supported through August, with the S&P500 making new all-time highs and Eurostoxx breaking through July highs, though still short of levels seen before the UK vote for Brexit. The European PMIs at the end of August were also reasonably positive, suggesting that there had been no obvious adverse effect from the UK Brexit vote in the short run.

- Commodity currencies were reasonably well supported, with the oil related currencies (CAD and NOK) benefitting from talk of OPEC efforts to restrict supply which helped the oil price to climb back up to the highest levels since late June.

- JPY strength was seen mid-month on the back of declining expectations of the Fed but faded by the end of the month as the BoJ made vague threats of intervention as USD/JPY tested below 100 and US yields firmed up on comments from Yellen and Dudley.

Outlook for September – Key Issues

(1) US monetary policy

Key events – US employment report September 2nd. FOMC meeting September 20/21.

- At this stage the market is only pricing a September rate hike as around a 25% chance, and given the usual cautious stance of the Fed we doubt that they will move in this environment, but strong data in the coming weeks could make a rate hike more probable

- The Fed will want a rate hike to be well anticipated. If they did raise rates in September when it was unexpected, they would risk a negative equity market reaction and a surge in the USD.

- September meeting consequently seems most likely to be a preparation for a December hike, unless data in the next few weeks is exceptionally strong.

- USD likely to gain on the month but may dip for a short period after the FOMC meeting if no rate hike.

(2) Sterling recovery?

Key events – UK PMI reports September 1st to 5th.

- Theme in the UK markets is starting to be the lack of any obvious immediate impact from the Brexit vote. If this impression gains momentum, there is potential for a more substantial GBP rally.

- There is evidence of a rally already. UK August PMI data September 1st (manufacturing) and 5th (services) is likely to set the GBP tone for the month. The manufacturing release was strong and resulted in a GBP spike. GBP rose to its highest level in four weeks against the dollar and the euro.

- If there is continued recovery after the sharp dip in the July indices, the recent GBP bounce has potential to extend towards 1.35. However, if the USD and equities remain firm there may be more potential for GBP gains against the JPY, CHF and EUR.

(3) Equities and oil

- Equities continuing to make new highs, though valuations in the US are looking stretched.

- Oil price recovery through August was based largely on talk of OPEC supply restrictions. Talks in Algeria this month may increase such speculation, but at this stage it is hard to see OPEC freezing output.

- The oil price should hold most of its recent gains ahead of the Algeria meeting, but the risks may be on the downside thereafter, which will tend to be negative for the oil related currencies (CAD and NOK), and typically positive for the USD based on recent correlations.

Bannockburn Global Forex, LLC is a boutique capital markets trading firm specializing in currency advisory and payment services. Our firm is purely client-oriented and our model combines expert counsel and pre-trade analytics with low-cost execution